Jaswinder learns how to protect herself financially after she and her husband separate.

If you find yourself in this position, you can get help from these resources:

Dealing with debts after you separate

Information about the basic guidelines around debts after separation for married and common-law couples.

Dividing property and debts after you separate

Describes what the law says about dividing property/debt, defines family property, family debt, and excluded property, sets out when unequal division is possible, and outlines time limits.

Protecting yourself financially after you separate

Describes the steps you can take to protect your property before final agreements or court orders are in place.

Transcript:

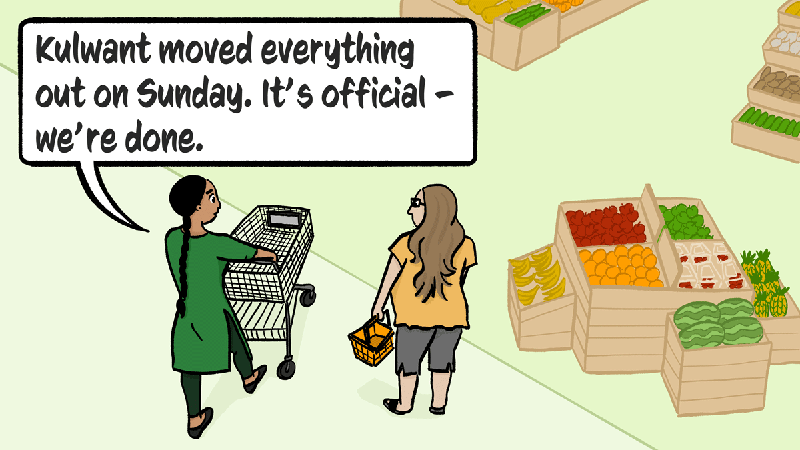

Panel 1: Jaswinder pushing shopping cart, Hannah holding basket at the grocery store

Jaswinder: Kulwant moved everything out on Sunday. It’s official – we’re done.

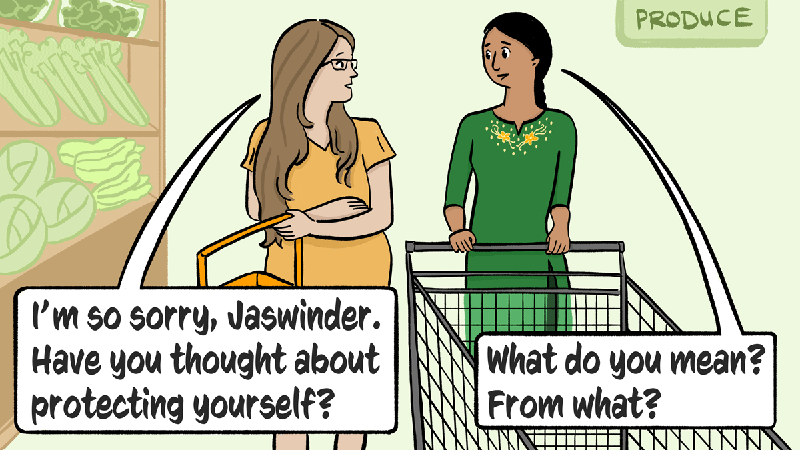

Panel 2:

Hannah: I’m so sorry, Jaswinder. Have you thought about protecting yourself?

Jaswinder: What do you mean? From what?

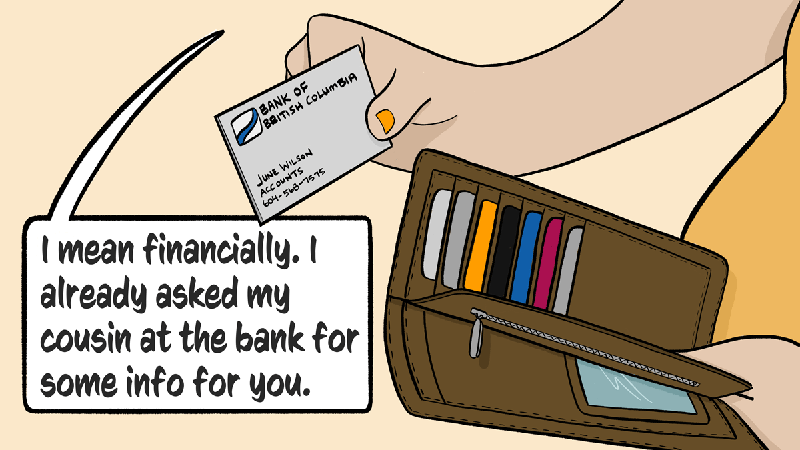

Panel 3: Close-up of Hannah pulling out a business card from her wallet

Hannah: I mean financially. I already asked my cousin at the bank for some info for you.

Panel 4:

Jaswinder: Really? Thanks, Hannah. Well, I do know we have to make a separation agreement since we own the condo together.

Panel 5: Hannah and Jaswinder selecting apples

Hannah: Yes, but before that you can do other things to protect yourself financially.

Jaswinder: Like what?

Panel 6:

Hannah: For starters, write down what you just told me – the date you separated.

Jaswinder: Why?

Panel 7:

Hannah: Because what you own as of Sunday is what you’ll divide up. So gather up documents for things like bank accounts, and the condo.

Panel 8: The two women chatting in aisle

Hannah: You also want to make sure Kulwant can’t sell or borrow against your property – there’s a form you can fill out.

Jaswinder: Oh!

Panel 9:

Jaswinder: What about all our debts? We owe so much money, Hannah!

Hannah: I know – you need to tell creditors right away that you’ve separated.

Panel 10:

Hannah: My cousin says to talk to your bank about joint accounts, reduce limits on shared credit lines, and cancel secondary credit cards.

Panel 11: Image of exterior of grocery store

Hannah: It can get complicated, and you may need legal advice, but you’ll feel better once you get a handle on what you own and owe.

Panel 12: Jaswinder and Hannah at the self-checkout

Jaswinder: Well, here’s on debt I don’t mind – I owe your cousin a big thank you.